2 Magnificent Dividend Stocks That I'm "Never" Selling

I am a dividend investor trying to build a portfolio of stocks that will help to provide me with income in retirement. When I see an attractively priced stock that has a solid business and an attractive dividend history, I go in for a deep dive.

That's what got me to buy Procter & Gamble (NYSE: PG) when it was unloved by Wall Street. And why I am so fond of Hormel Foods (NYSE: HRL) today, while it is unloved. Here's why I'm not selling either one of these consumer staples Dividend Kings.

Procter & Gamble: I took a risk, and it paid off

Procter & Gamble has increased its dividend annually for a huge 68 consecutive years, landing it soundly in the Dividend Kings camp. I bought it a number of years ago, when the company was rejiggering its portfolio. Simply put, over time the product lineup had become bloated and unwieldy.

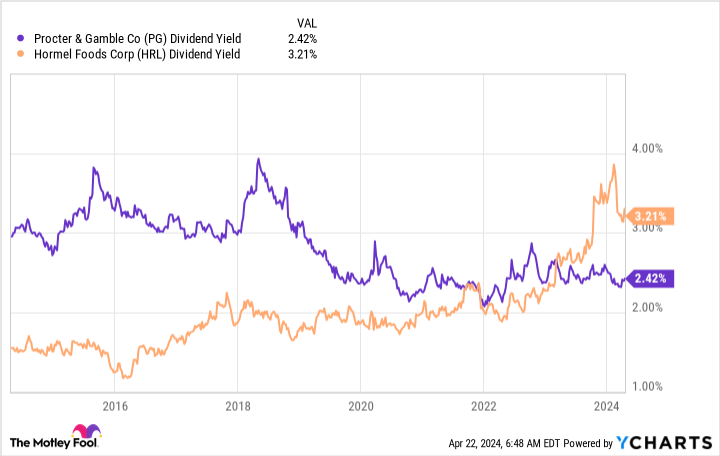

Management made the decision to sell off smaller and less profitable brands so it could refocus around its most important ones. But Wall Street was worried that the company had lost its way and pushed the yield up toward 4%. That's historically high for P&G, and I jumped on the chance to buy it.

Today, the yield is just 2.5%, and the dividend has been increased every year since I bought it. I'm sitting on sizable capital gains, but I'm not looking to take profits. The reason is simple: I bought P&G because it is probably one of the best-run consumer staples companies on the planet.

The consumer staples sector is generally fairly reliable because companies like P&G make products that are used every day and bought frequently. They are necessities that we can't do without, like toothpaste, laundry detergent, and toilet paper.

P&G owns some of the best-known brands in the sector, too. It is large, diversified, and a key partner for retailers. Most importantly, P&G focuses a lot of effort on research and development. This keeps its products at the leading edge of the industry.

And that allows it to charge higher prices and to expand categories, which retailers really appreciate. I have a value bent, so I probably wouldn't buy P&G shares today (they appear fully valued), but I'm certainly not going to sell today or, hopefully, ever.

I've built up a full position in Hormel

Hormel is another story completely. The dividend yield is currently 3.2%, which is toward the high end of its historical yield range. And, like P&G, Hormel is a Dividend King, with 58 years of annual dividend increases behind it. That's the type of story that gets my attention, just like it did with P&G.

The negatives that have food maker Hormel on the outs with investors are very real. For example, it hasn't been able to pass on rising costs to consumers as well as peers have been able to, it has been struggling with avian flu affecting its supply chain, it bought Planters just as the nut segment of the snacking niche was slowing down, and a slow COVID reopening in China has hampered Hormel's global expansion plans.

These are real problems, but they are all likely to be solved in time. And considering the long history of dividend increases, I'm willing to give management the benefit of the doubt. It has muddled through hard times before over the last half-century or so. I think it will do so again, just like P&G did when it was struggling.

There's one more unique wrinkle with Hormel, however, that makes me extra willing to take on some risk. The company's largest shareholder is the Hormel Foundation, which uses the dividends it collects from Hormel to make donations to charities.

The Hormel Foundation's expectations are basically aligned with mine, and it has a big voice at the company, given that it has nearly 47% of the voting control of the stock. I don't think the Hormel Foundation is going to sit idly by if the Hormel management loses its way, which effectively means I have an advocate that shares my desire for reliable dividends.

Act now with Hormel, with P&G as the example

It took a few years for P&G to reset its business and get back into growth mode. I'm sure that will be true for Hormel, too. But P&G is a good example of what can happen when you buy a well-run company while it is facing problems that are likely to be temporary.

It's too late to buy P&G on the cheap, but Hormel is currently out of favor, so you can still buy it while it is on sale. Which is exactly what I've done, with the goal of holding it forever, just like I'm doing with P&G.

Should you invest $1,000 in Procter & Gamble right now?

Before you buy stock in Procter & Gamble, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Procter & Gamble wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Reuben Gregg Brewer has positions in Hormel Foods and Procter & Gamble. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Magnificent Dividend Stocks That I'm "Never" Selling was originally published by The Motley Fool