This High-Ranking Republican Supports an Off-the-Wall Solution to Tackle Social Security's $22.4 Trillion Cash Shortfall

Social Security income is a necessity for most retirees. Based on more than two decades of annual surveys undertaken by national pollster Gallup, no fewer than 80% of then-current retirees rely on their monthly benefits to cover some portion of their expenses. The mere existence of Social Security ensures that most seniors can make ends meet.

That's what makes this next statement such a gut-check: Social Security is in trouble.

Although America's top retirement program is in no danger of going bankrupt or becoming insolvent, the foundation that supports the existing payout schedule, including annual cost-of-living adjustments (COLAs), may be less than a decade from breaking. Social Security needs attention, and the American public is counting on their elected officials in Washington, D.C., to get to work.

While lawmakers on Capitol Hill have laid out no shortage of Social Security reform proposals, it's one completely off-the-wall approach from the current highest-ranking Republican, House Speaker Mike Johnson (R-LA), which could raise eyebrows.

Social Security is facing a long-term funding obligation shortfall of more than $22 trillion

Before diving into the nuts and bolts of Johnson's proposal, it's important to understand why America's leading retirement program is facing an ever-widening funding obligation shortfall estimated to have reached $22.4 trillion through 2097.

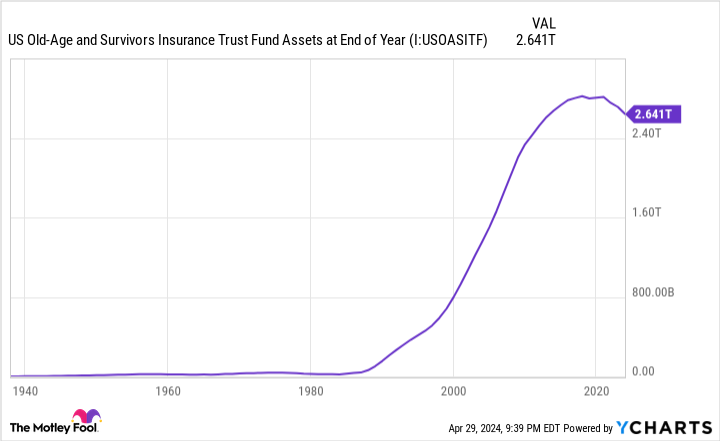

The biggest concern is that the Old-Age and Survivors Insurance Trust Fund (OASI), which pays monthly benefits to over 50 million retired workers and roughly 5.8 million survivors of deceased workers each month, will exhaust its asset reserves by 2033. If and when these asset reserves are depleted, sweeping benefit cuts of up to 23% may be necessary to sustain payouts, without the need for any further reductions, through 2097.

While social media message boards are rife with fairy tales about "Congress stealing funds" and "undocumented workers receiving benefits," the reality is that visible and off-the-radar demographic shifts are responsible for Social Security's struggles.

For example, most people are likely well aware that baby boomers are retiring from the workforce and that longevity has increased since the first retired-worker benefit was mailed out in January 1940. But people may not realize that a historically low U.S. birth rate, a more-than-halving in net legal immigration into the U.S. since 1998, and a steady rise in income inequality have also contributed to the program's growing long-term funding obligation shortfall.

Although Social Security will absolutely be there for you when you retire (assuming you've earned the requisite number of work credits to receive a benefit), the amount you receive each month could be far less than expected if Congress doesn't act soon.

House Speaker Johnson supports an unorthodox approach to strengthening Social Security

Despite being relatively tight-lipped about Social Security since becoming House Speaker, Mike Johnson has historically not been shy about supporting proposals designed to reduce the program's long-term outlays.

During the 116th Congress, Johnson was the Chair of the Republican Study Committee (RSC), a conservative caucus of House Republicans. For fiscal 2020 (the federal government's fiscal year ends on Sept. 30), the RSC and Mike Johnson released a nearly 200-page budget that aimed to reduce costs in all facets of government -- including Social Security. The RSC's budget proposed implementing the Social Security Reform Act that former House Rep. Sam Johnson (R-TX) first introduced in 2016.

The 10 Social Security changes Mike Johnson's budget supported are as follows:

Gradually increase the full retirement age and early retirement age: The Social Security Reform Act would gradually move the peak full retirement age -- i.e., the age you're eligible to receive 100% of your payout -- and the initial retired-worker claiming age from a respective 67 and 62 currently to 69 and 64.

Index the full retirement age and early retirement age to longevity: Once the full retirement age and early retirement age reach their respective targets of 69 and 64, they'd be indexed for longevity. In other words, if people are living longer, the full retirement age and earliest retired-worker claiming age would also climb.

Switch the COLA measure from the CPI-W to Chained CPI-U: The current measure for Social Security's COLA, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), is flawed. Johnson's plan replaces the CPI-W with the Chained CPI-U, which accounts for substitution bias. In other words, if the price of a good or service rises, consumers will trade down for a cheaper but similar good or service. The Chained CPI-U would result in lower COLAs over time.

Update the Chained CPI-U to better reflect shelter costs for homeowners: The new Chained CPI-U formula would be updated to reflect that most retired beneficiaries are homeowners and not renters.

No COLAs for high earners: No COLA would be provided for single filers and couples filing jointly with respective incomes above $85,000 and $170,000 (remember that these figures are from a few years ago). This is effectively a form of means-testing for benefits.

New benefit formula for future retirees: A new benefit formula would be used for future retirees, providing beefier benefits for lifetime low-earning workers and slower benefit growth for high earners.

Introduce a new special minimum benefit: People with at least 10 years of qualified work history would qualify for a new minimum benefit.

Get rid of the retirement earnings test: Johnson's Social Security Reform Act would do away with the retirement earnings test, which allows the Social Security Administration to partially or fully withhold benefits for early filers who earn too much. This move is designed to encourage early filers to continue working.

Provide partial lump-sum benefits to those who wait: Additionally, this proposal would allow those willing to wait to claim their benefit the possibility of taking a partial lump-sum payout to go along with a higher monthly check.

Phase out the taxation of benefits: Lastly, Johnson supports phasing out the taxation of Social Security benefits by 2045. There are currently two tiers that allow up to 50% or 85% of benefits to be taxed at the federal level if a single filer or couple have provisional income above preset thresholds. These provisional income thresholds have never been adjusted for inflation.

These sweeping reforms supported by the RSC and then-Chair Mike Johnson were estimated to reduce spending on America's top retirement program by $756 billion over 10 years.

A bipartisan solution will likely be needed to tackle Social Security's funding shortfall

Although the scope of the RSC's proposal is unlike anything we've seen before from Capitol Hill, it, like other legislation before it, would struggle to get off the ground in the House and/or Senate. One of the biggest issues with Social Security reform is that all proposals result in some group of people being worse off.

For example, President Joe Biden and his Democratic colleagues have proposed reinstating the 12.4% payroll tax on earned income above $400,000. Currently, only earned income (wages and salary but not investment income) between $0.01 and $168,600 is subject to the payroll tax. Though reinstating this tax would provide Social Security with an immediate influx of revenue, it wouldn't provide an added cent in benefits for the high earners paying this extra payroll tax.

On the other hand, Republicans (including Mike Johnson) have often touted a gradual increase to the full retirement age as a viable solution to reducing long-term outlays. The problem is that raising the full retirement age will lower the long-term benefits collected by lifetime low-earning workers.

Fixing Social Security means making a hard decision and putting a certain group of Americans on worse financial footing than they were prior to reforms.

What's more, both parties' proposals have unique flaws. The GOP plan takes decades to yield significant cost reductions, which wouldn't provide any help to the OASI's impending asset reserve depletion in nine years. Meanwhile, taxing the rich by itself doesn't come close to overcoming Social Security's $22.4 trillion funding shortfall.

Just as we witnessed when the Social Security Amendments of 1983 were signed into law, the best approach to strengthen Social Security's foundation will be one that incorporates solutions from both parties. Since it takes 60 votes in the Senate to amend Social Security, fixing this program will require collaboration.

Though Mike Johnson is unlikely ever to gain bipartisan support for his broad-reaching Social Security plan, it serves as a reminder that off-the-wall solutions from both parties may be necessary to shore up this program for future generations of retirees.

What stocks should you add to your retirement portfolio?

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

The Motley Fool has a disclosure policy.

This High-Ranking Republican Supports an Off-the-Wall Solution to Tackle Social Security's $22.4 Trillion Cash Shortfall was originally published by The Motley Fool