Verizon Communications Is the Best-Performing Telco Stock in 2024. Should You Buy?

It may surprise many investors that Verizon Communications (NYSE: VZ) is the top-performing telecom stock in 2024. Indeed, it benefits from being one of only three 5G providers, and the industry's massive fixed costs make it unlikely that additional competitors will enter it.

However, such costs have also burdened Verizon in other respects. Such conditions may lead to questions as to whether payout increases are sustainable.

Verizon's outperformance (so far)

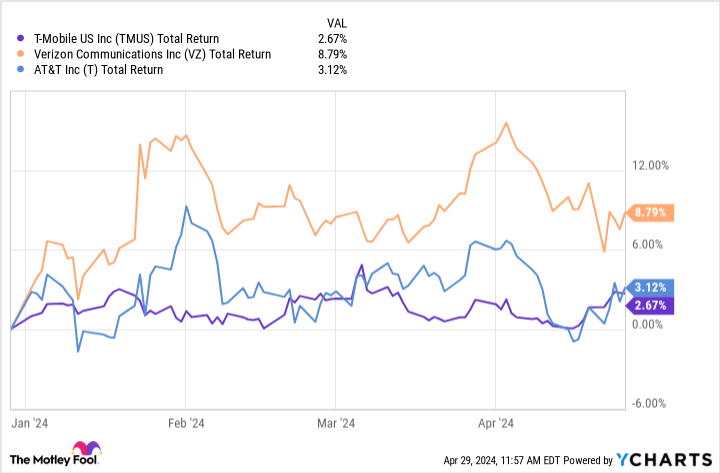

In the first four months of the year, Verizon has returned around 9% to investors. A portion of the return is dividends. At an annual payout of $2.66 per share, shareholders earn a dividend yield of 6.7% annually, or just under 1.7% so far this year.

The remainder comes from stock gains. Rising optimism about 5G and a P/E ratio, which now stands at around 15, have likely made Verizon stock an appealing alternative to higher-priced stocks in other parts of the tech industry.

Also, its peers, AT&T and T-Mobile, have only returned about 3%.

Nonetheless, when looking at a time period of one year or longer, T-Mobile remains the highest-performing stock. It stands out in two aspects. For one, it began as a wireless company, meaning it did not have the legacy wireline businesses that have become a burden to Verizon and AT&T.

Moreover, until last December, T-Mobile did not pay a dividend. In contrast, Verizon and AT&T have offered payouts since soon after the breakup from the original AT&T in the early 1980s. Additionally, the high cost of AT&T's dividend led to the company slashing its payout in 2022.

Dividend challenges

So far, Verizon has maintained its dividend, which includes a 17-year streak of payout hikes. Still, that comes at an annual cost of $11 billion per year.

Also, while Verizon did not make the strategic missteps that led to AT&T's dividend cut, it may have to consider slashing its payout due to one factor -- debt.

The total debt amounts to $152 billion. Not only has that increased slightly from last year, but it is significantly above Verizon's $96 billion in total equity, placing a tremendous burden on the company.

Worse, nearly $16 billion of that debt matures over the next year. Hence, with just over $2 billion in cash, it will likely have to refinance that debt at a higher interest rate. Interest expenses, which were $1.6 billion in the first quarter, rose 36% from last year, and with the increases unlikely to stop, Verizon could face a cash crunch.

Unfortunately for income investors, the obvious solution may be to slash the payout and allocate some or all of the $11 billion in annual dividend costs to reducing debt. That move will probably upset many of its investors.

Also, walking away from a long-term record of payout hikes will probably diminish confidence in the stock for at least a time. So, while that move may be good for the company, Verizon stock will almost certainly suffer in the short run and maybe beyond.

Avoid Verizon stock for now

Given Verizon's financial state, investors should probably sell the stock. Admittedly, Verizon's network is critical to the tech industry, and the company is likely to remain a major 5G player.

However, its massive debt and rising interest rates place increasing strain on the balance sheet. In the end, an eventual dividend cut is probably unavoidable, making it likely the aforementioned outperformance is likely not sustainable.

If Verizon can reduce its debt, investors should reevaluate the stock. Nonetheless, until Verizon strengthens its balance sheet, investors should probably look elsewhere for returns.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

Verizon Communications Is the Best-Performing Telco Stock in 2024. Should You Buy? was originally published by The Motley Fool